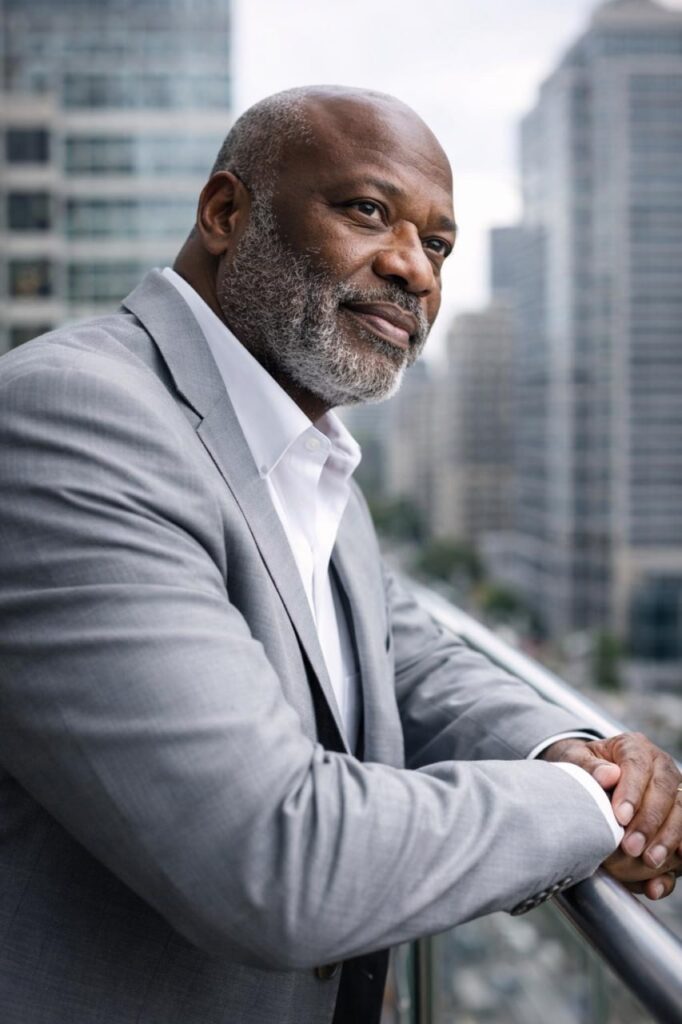

Professor John Tunbosayo Okekunle

A Bridge Between Two Worlds

Professor John Tunbosayo Okekunle is a distinguished financial scholar and seasoned equity strategist whose career has been defined by a relentless pursuit of analytical excellence. Long established in the United Kingdom, the Professor built a formidable reputation within the competitive landscape of the London financial markets. His tenure in the UK was marked by providing premium equity investment research services and sophisticated market insights to a diverse array of institutional and high-net-worth investors.

The Manifesto of Return

Why I Answered the National Call

Answering the national call to service, Okekunle Equity Partners (UK) Ltd. introduces the TAF (Tos Alpha Fund) —a landmark initiative combining international equity expertise with a sovereign mandate to transform Nigeria's financial landscape from its foundation.

“My return to Nigeria was not a decision based on commercial calculation, but one born of a profound sense of duty. After years of analysing global markets from the heart of London, I observed a recurring paradox: Nigeria possesses immense economic potential and vibrant entrepreneurial energy, yet it lacks the long-term, institutional capital structures necessary to sustain growth.”

“When the Nigerian Economic Council (NEC) extended a formal invitation for me to return, the objective was clear: we must move beyond the era of ‘hot money’ and speculative volatility. My mission is to transplant the discipline of international markets into the fertile soil of the Nigerian Exchange. We are here to prove that through transparency, world-class governance, and investor education, Nigeria can become the primary destination for strategic global capital.”

Okekunle Equity Partners:

A Foundation of Global Standards

Okekunle Equity Partners (UK) Ltd. is a UK-registered investment entity that serves as the strategic backbone for the TOSAF fund. The firm was established with a singular focus: to apply institutional-grade analytical frameworks to emerging market opportunities. By maintaining our headquarters in the UK, we ensure that our operations are governed by the highest global standards of financial reporting, transparency, and fiduciary responsibility.

Transparency

We believe that trust is earned through the unconditional disclosure of data and decision-making processes.

Discipline

We adhere to strict, data-driven investment protocols, rejecting the noise of market sentiment.

National Impact

Every investment we make is measured not just by its ROI, but by its contribution to the national economic fabric.

Translating Global Insight into Local Prosperity

The "Knowledge Repatriation Programme" is the operational philosophy of our firm. It recognises that capital alone is insufficient to reform a market; it must be accompanied by the "Intellectual Infrastructure" of modern finance. Professor Okekunle and his team of experts bring with them a wealth of experience in risk modelling, asset allocation, and corporate governance—tools that are being integrated into the Nigerian market through the TAF framework.

A Dual-Jurisdictional Framework for Security

To provide international investors with the ultimate peace of mind, TAF utilises a governance structure that harmonises UK institutional standards with Nigerian regulatory compliance. Our partnership with the Nigerian Economic Council ensures that we are aligned with the highest level of sovereign economic policy, while our UK roots guarantee a level of oversight that meets the expectations of the world's most sophisticated investors.